The Annual Bee Bus + Tram Ticket

Tram + Bus = Less of the Fuss

Enjoy unlimited annual travel on buses and trams across Greater Manchester with weekly or monthly repayments at no extra cost with the Annual Bee Bus + Tram Ticket.

You now have the option to spread the cost of yearly bus and tram travel through your local credit union. You will save 15% compared to 13x 28-day tickets.

Sound alright to you?

Follow these 4 simple steps:

✅ Choose which ticket is right for you

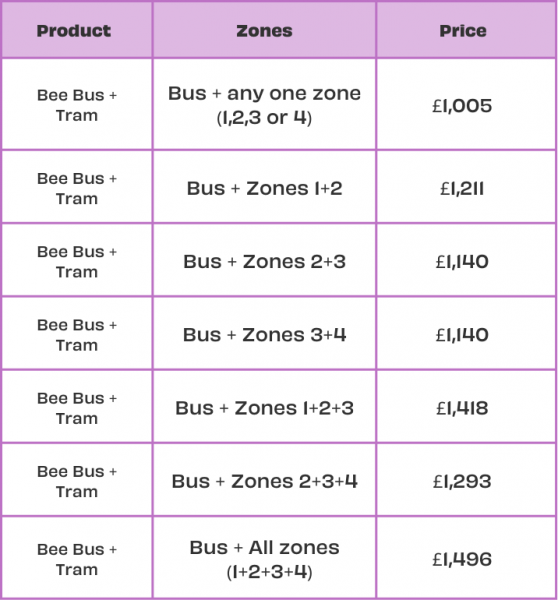

The Annual Bee Bus + Tram Ticket has different prices depending on where you travel on the tram – you only pay for the tram zones you travel through. You can still travel on all Bee Network buses across Greater Manchester with all Annual Bee Bus + Tram Tickets.

Use TfGM’s ‘find your tram zone’ tool if you need a hand. Once you’re set on your zones, find the cost of your ticket on our ticket pricing guide.

🤝 Match with your credit union

Now you know which ticket you’re getting, you’ll need to apply at a credit union in Greater Manchester. Enter the postcode where you live or work into our Credit Union Matcher below to find your credit union.

📅 Apply for your Annual Bee Bus + Tram Ticket

Follow the steps at your credit union to apply for your Annual Bee Bus + Tram Ticket. Make sure to state your preferred product (e.g. Annual Bee Bus + Tram Ticket) and tram travel zones (e.g. 1,2, and 3). Complete the application and they’ll get back to you shortly!

🍵 Sit back, relax, and enjoy the bus + tram

Your credit union will carry out the necessary ID and affordability checks. Once your loan is approved, you’re ready to go! TfGM will contact you about collecting your ticket and then Greater Manchester is your oyster.

Just looking for annual bus or annual tram travel? We offer other tickets suited just for you. Check out the Annual Bee Bus Ticket and the Annual Tram Ticket.

Credit Union Matcher

Use this easy tool to match with a credit union in Greater Manchester and spread the cost of the annual Bee Network Tickets. Search for your employer or your postcode to find your SoundPound credit union.

Helpful Information before you apply:

-

Eligibility criteria:

- You must qualify for membership for a participating credit union – You must live or work in an area covered by a credit union. Typically, this includes Greater Manchester, but some areas like Warrington or Glossop are also covered. Use the Postcode Matching tool above to check your eligibility.

- You must be 18 or older to apply for a loan.

- You are more likely to be accepted if you: Have a regular source of income with surplus funds after covering monthly loan repayments, stay current on existing credit commitments & manage a reasonable level of debt.

-

Likely reasons for loan denial:

- If you’ve had defaults or a County Court Judgement (CCJ) in the last year, your application may be denied.

- If you are undergoing bankruptcy, an Individual Voluntary Arrangement (IVA), or a Debt Relief Order (DRO) we may not be able to offer you a loan.

-

Financial advice:

- If you’re currently not up to date with household bills or under any debt management plan, it’s unlikely we can provide a loan. But you can seek free debt advice from organisations like StepChange, Debt Advice Foundation or your local Citizens Advice.

- For free and impartial money advice, reach out to MoneyHelper.